|

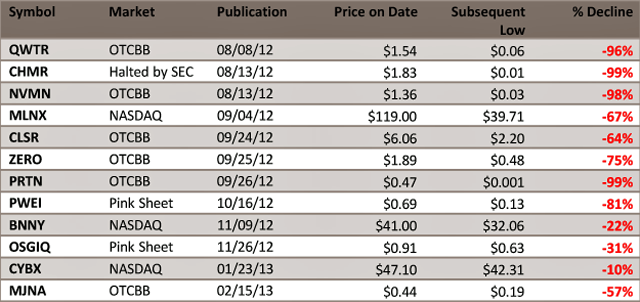

2 April 2013 Off the Tracks After Ackman Infitialis Introduction Investors in industries deemed popular or in vogue by the general public have a propensity to engage in folly often resulting in the manifestation of valuation bubbles for the pioneering companies. As the great Charles Mackay wrote in 1841: "Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one." Nearly two hundred years later, these words are still relevant as even nowadays men find it difficult to act against the herd while the herd goes mad. Infitialis is a research collective that exposes fraud and folly in an effort to identify bubbles before they implode. Our track record of success speaks for itself. In this report, we will be exposing folly on the scale of our prior report on Mellanox Technologies, Ltd. in September 2012 when the firm's shares were trading at a shocking US$119/share Infitialis Track Record of Exposing Fraud and Folly is Unmatched

Canadian Pacific Introduction Like Bill Ackman's legendary bicycle ride on the Montauk Highway last summer, the Canadian Pacific Railway Limited ("Canadian Pacific" or the "Company" NYSE/TSX: CP) share price has recently spurted ahead of its comparibles in an unsustainable fashion as it has more than doubled to US$126.96/share from US$60.62/share before Ackman started his activist campaign less than 18 months again. While Canadian Pacific's recent share price performance is impressive, investors may soon be yelping in pain like Mr. Ackman when his Montauk bike-ride pace faded and debilitating leg-cramps set in.

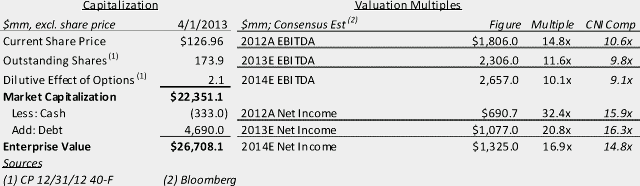

Canadian Pacific's potential economies-of-scale are significantly limited relative to its peers because the Company operates a significantly smaller network of only 14,400 miles of track through predominately rural areas with approximately 55% of the geographic footprint in Canada and the remainder in the United States. For comparison, Canadian National Railway operates the largest rail network and the only transcontinental network in North America with over 20,600 route miles of track. Moreover, from an operational perspective, Canadian Pacific is less competitive than its peers as it has a higher average track grades because of its Canadian Rockies crossings (estimated 2-3%) which significantly increases its fuel costs (with limited pass-through ability to customers), has less United States connectivity, is more northerly, and has a higher mileage concentration in Western Canada (40% of volumes). The latter two factors drive increased winter network outages due to snow, flooding, and landslides. Moreover, the steeper average track grades and mountainous geographic footprint increases the capital intensity of the business relative to its peers and makes it more difficult for even the most talented management teams to effect operational improvements, such as average train velocities and locomotive dwell times. Recently, Canadian Pacific was subject to a proxy battle (publicly launched 28 Oct 2011 when shares were trading at US$60.62/share) which was initiated by Mr. William Ackman of Pershing Square Capital Management, L.P. of New York ("Pershing Square"). Pershing Square believed Canadian Pacific was ineffectively operating the railway and successfully removed the prior C-suite management team as well as several sympathetic board members. Pershing Square then was able to select Mr. E. Hunter Harrison as the new Chairman of the Board and CEO for Canadian Pacific on 28 Jun 2012. Mr. E. Hunter Harrison is best known for his prior leadership of the Canadian National Railway Company and Illinois Central Railroad Company, but his recent track-record is of more concern with the $4 billion bankruptcy of Dynegy Inc. and the independent finding of a "fraudulent conveyance" of certain of the firm's key assets while he served as Chairman and CEO. Pershing Square owns 24.2 million shares of CP, approximately 13.9% as of 31 Dec 2012, for a current market value of US$3.1 billion, or >30% of Pershing Square's total AUM. Interestingly, Mr. William Ackman's subsequent activist campaign on Herbalife (NYSE: HLF), which utilized the same techniques as his CP battle including a massive conference presentation and extensive media engagement, almost immediately blew-up in his face as the market quickly poked significant holes in his thesis and took a countervailing position, driving the share price above the level before Pershing Square's presentation. While this dynamic may take longer to play out for the CP situation, it seems the market could quickly revert once these and other flaws are exposed in the Pershing Square investment rational for the Company. Canadian Pacific Summary Valuation Metrics:

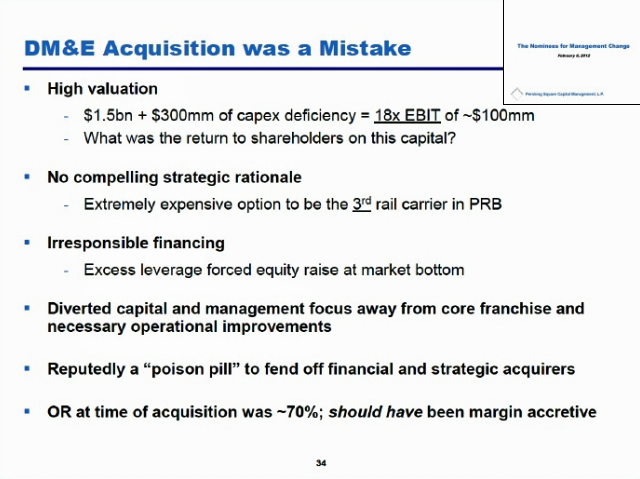

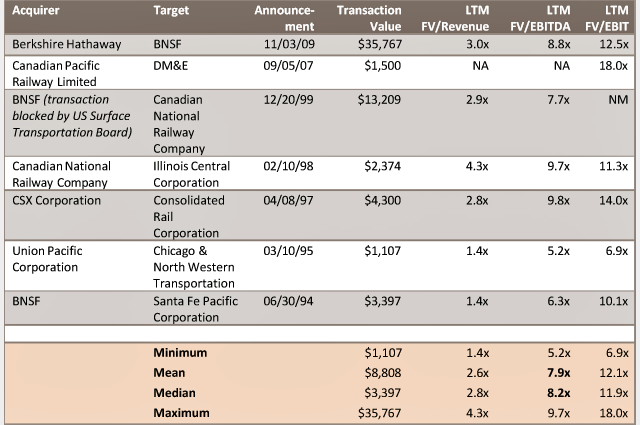

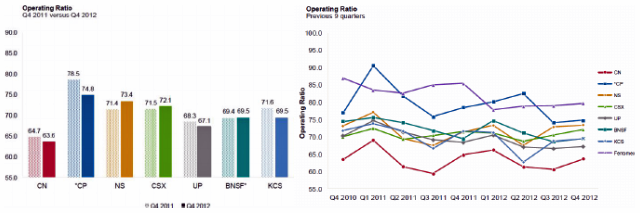

Interestingly, during the proxy contest, one of the purported failures highlighted by Pershing Square of the prior management team of Canadian Pacific was its 30 Oct 2008 acquisition of the Dakota, Minnesota, & Eastern Railroad Corporation ("DM&E") for US$1.8 billion at an 18.0 x LTM EBIT multiple. Astute investors would note that because of the recent run-up in Canadian Pacific's share price, the Company is currently valued at a shocking three full turns higher at 21.1 x LTM EBIT. Investment Thesis - SHORT Canadian Pacific Because of the recent and unsuitable run-up in equity valuation, Canadian Pacific is a compelling short opportunity because of 1) an irrational market assumption regarding the timing and feasibility of the railroad operational improvement plan, 2) sub-optimal corporate governance oversight, and 3) impending Pershing Square liquidation of CP common stock following the implosion of their recent J.C. Penney Company, Inc. (NYSE:JCP) investment and limited partner redemptions following their bolloxing of the Herbalife situation coupled with a purported SEC investigation into Pershing Square's trading activity. The current irrational market behavior appears to exist because many investors have been blindly riding the coat-tails of Pershing Square's pre-2012 success on such names as MBIA Inc.(NYSE:MBI), and General Growth Properties Inc. (NYSE:GGP), which conveniently overlooks Ackman's prior implosion of Gotham Partners and failed activist investments in Borders and Target. These primarily Canadian-based individuals, funds, and sell-side analysts are largely playing a momentum trade, not a fundamental investment, in CP shares. Further, in their blind following of Bill Ackman, it seems that they are quick to forget that Pershing Square's position has been completely illiquid to date, due to the size of the position and reputation risks of selling shortly after installing their own management team. Finally, the risk of a merger take-out, long rumored, seems extremely diminished at this point in time because of the exceedingly rich valuation of CP relative to is peers and anti-trust regulatory concerns in Canada and the United States. Canadian Pacific Turn-Around Plan is Fatally Flawed CP shares are currently pricing in full achievement, with no room for shortfalls or delays, of an aggressive turn-around plan. This plan contemplates both achieving an Operating Ratio ("OR") of 65% by 2016 and generating a revenue CAGR of over 6% from 2012-2016. The lowest annual OR that CP has achieved in the last 20 years was 75.3%, approximately 1,000 bps above the OR that the stock is currently discounting and also the most recent 4th quarter 2012 performance by Mr. E. Hunter Harrison. Moreover, CP was the only Class 1 railroad to have significantly lower train velocity on their network, YoY, in January 2013. CP is clearly trading as a "story" instead of an investment based on the underlying operational performance of the business at this time. North America Railroad Operating Ratio Trends

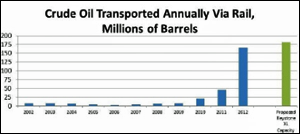

Of particular note, the market seems to believe CP can transition from a bottom decile OR performer to a market-leading firm in less than four years. Moreover, CP Management and sell-side estimates earnings estimates are paired with exceedingly aggressive CAPEX intensity targets, as forecasted CAPEX spend is to be below both CP and CNI precedents. Simply put, in railroading, it is difficult to increase operational efficiency without sustained investment in new equipment and technology to both capture incremental efficiency improvements in new technologies and avoid equipment malfunctions and delays associated with service outages and delays. Blood on the Tracks - Oil-on-Rails Future Potential is Over-Played In addition to a dramatic operational improvement, CP bulls have priced-in significant revenue growth from crude oil-on-rails transport as oil/gas producers choose to ship liquids from Alberta and North Dakota via rail versus being subject to heavy negative pricing differentials on the constrained existing pipeline capacity. Mr. E. Hunter Harrison, CP's Chairman and CEO, has done little to temper investors' expectations, declaring on the 24 Oct 2012 investors call, "If you put it (oil-on-rails projects) all together, it'll make people forget the Gold Rush in 1849." CP has attempted to capitalize on the boom in crude transport, forecasting its US$90 million in CAPEX will allow it to transport nearly 70,000 carloads a year by 2014, up from the only approximately 500 carloads in 2009.

Just last week on 27 Mar 2013, CP demonstrated the significant dangers of shipping crude oil via rail when 14 cars on its 94-car train heading for the Chicago area crashed off the CP tracks approximately 150 miles northwest of Minneapolis near the town of Parkers Prairie. The derailed crude tanks released a gusher of more than 30,000 gallons of untreated crude oil onto the prairie, shutting the rail line for an estimated 2-3 days, and requiring a massive remediation effort to clean up the literal river of crude oil. Luckily, the derailing happened in a relatively rural area and the spilled crude did not combust, but this is a poignant example of the potential risks of shipping highly volatile cargos on relatively old tracks. Moreover, it reiterates the importance of the continuous CAPEX investment required to ensure tracks and trains remain in safe and efficient operating condition. CP March 27, 2013 Railcar Derailment in Minnesota

As an analogy to the current oil-on-rails mania, investors would be well-served to review CP's disastrous 30 Oct 2008 acquisition of the Dakota, Minnesota, & Eastern Railroad Corporation ("DM&E") for US$1.8 billion at an 18.0 x LTM EBIT multiple. At the time of the acquisition, bullish investors were excited about CP's possibly to start hauling Powder River Basin ("PRB") coal and capture a portion of the rich "dark-spread" pricing differential between natural gas and coal commodities at the time. Moreover, DM&E's 70% OR at the time of acquisition was supposed to be accretive to CP's operating statistics. However, CP paid this significant premium to become the 3rd rail provider in the PRB, a relatively weak strategic position in freight negotiations with potential customers. In 4th quarter 2012, CP announced it was indefinitely deferring plans to complete the expansion of its rail network within the PRB region and was forced to take a US$180 million impairment on construction and land option expenses. Pershing Square Activist Campaign Deck - February 2012

Like the CP's strategic position in the PRB for coal, CP is also competing with BNSF and CNI for oil on rail shipments, both of whom arguably have better and faster network connections with the Bakken field and PADD II/III refineries. With CP currently trading at 21.1 x LTM EBIT, investors should consider purchasing the Company at the current market valuation is a replay similar to the DM&E acquisition disaster. Post-Pershing: An Improvement in Governance? After all the drama involving Pershing Square's proxy rebellion, investors seem to be blindly assuming that that new slate of management and Board of Directors will result in a dramatic increase in operational efficiency and shareholder returns. However, a closer review of their respective biographies raises some significant governance concerns. E. Hunter Harrison - Chairman of the Board and Chief Executive Officer Moreover, after the dramatic run-up in CP's share price, it seems prudent for investors to remember Warren Buffett's (a now proven railroad investor and executive, in addition to all his other accomplishments) extremely prescient quote from 1989, "When a management team with a reputation for brilliance tackles a business with a reputation for bad economics, it is generally the reputation of the business that remains intact." Richard C. Kelly - Board of Directors and Chairman of the Audit Committee, Finance The Hon. John P. Manley - Board of Directors, Audit and Finance Committee William A. Ackman - Board of Directors, Corporate Governance and Finance Committee Paul C. Hilal - Board of Directors, Finance and Compensation Committee Rebecca MacDonald - Board of Directors, Finance and Compensation Committee Pershing Square Will Become a Forced Seller After reviewing the current market dynamic, it appears an impending Pershing Square liquidation of CP common stock is looming. First, Pershing Square's high-profile investment in J.C. Penney Company Inc. (NYSE:JCP) has imploded after the last year as Bill Ackman's hand-picked CEO, Ron Johnson, alienated the Board of Directors and failed to halt a >30% in same store sales. It is estimated that Pershing Square has lost > US$200 million on their JCP investment. Next, on 19 Dec 2012, Bill Ackman launched a high-profile short-sale campaign against Herbalife Inc. (NYSE: HLF). After Ackman publicly admitted to shorting over 20 million HLF shares, Third Point and Icahn Associates took an opposing long position, driving share prices higher than the price before the Pershing Square presentation in a "mother of all short-squeezes". As the Pershing Square limited partner begin to realize a significant portion of their net worth is now tied to a single controversial stock, investor redemptions are posed to skyrocket. Investor redemptions will require Pershing Square to liquidate its long positions, such as its largest holding CP. Finally, based on the SEC FOIA response, it appears the United States Securities and Exchange Commission is now investigating Pershing Square and William Ackman's trading regarding Herbalife. This will also likely cause LPs to reconsider their association with Ackman and CP. It is also important to review the differences in the background and perspective of the notable self-made investor Carl Icahn, who grew his net worth inch by inch over decades with investment acumen, as opposed to Bill Ackman, who primarily grew rich from management fees on billions of others people money under management. Moreover, Ackman appears to have taken an inordinate sizing risk as the trading volume of CP indicates that Pershing Square's position is way too large for a dynamic capital fund should he face any redemptions in the future. Precedent Transaction Multiples and Canadian Resource Protectionism Limits Take-Over Risk Below are ALL the significant railroad mergers in North America in the last 20 years with a transaction value great than US$1 billion. Please note this is also the same comparable transactions peer-set Evercore utilized in its fairness opinion for the BNSF acquisition by Berkshire Hathaway.

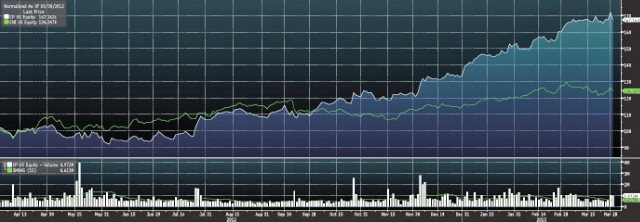

Based on these precedent transaction multiples, it seems difficult to believe that even if the United States and Canadian anti-trust regulators would approve further consolidation within the industry, that a strategic acquirer could afford to pay more than 7-10 x CP's LTM EBITDA, or US$47.63-US$78.78/share. In addition, the Brookfield Asset Management and Caisse de depot et placement du Quebec buyout consortium that purportedly expressed a preliminary indication of interest in CP back in 2007 would be unable stump up the >US$30 billion premium enterprise value check and limited capacity for additional leverage, which is more than double the enterprise value of CP back in 2007 when rumors started to circulate within the marketplace. Moreover, because of the recent displays of Canadian resource nationalism and protectionism, it seems unlikely that Canadian anti-trust regulators would allow one of its two remaining Class 1 railroads be acquired by a foreign firm or merged into another railroad. First, on 10 Apr 2008, the Canadian Government blocked the proposed US$1.3 billion sale of Canadian aerospace and information technology firm MacDonald Dettwiler & Associates Ltd. to U.S. defense company Alliant Techsystems Inc. on national security grounds under the Investment Canada Act, which is rather ironic considering Canada has never been invaded! Editor's Note: Yes it has, by you Americans. On 12 Jul 1812, General William Hull led an invading American force of about 1,000 untrained, poorly equipped, militia across the Detroit River and occupied the Canadian town of Sandwich (now a neighbourhood of Windsor, Ontario). By August, Hull and his troops (numbering 2,500 with the addition of 500 Canadians) retreated to Detroit, where they surrendered to a force of British regulars, Canadian militia, and Native Americans, led by British Major General Isaac Brock and Shawnee leader Tecumseh. The surrender not only cost the United States the village of Detroit, but control over most of the Michigan Territory. Several months later, the U.S. launched a second invasion of Canada, this time at the Niagara peninsula. On 13 Oct 1812, United States forces were again defeated at the Battle of Queenston Heights, where General Brock was killed - Wikipedia Under the Investment Canada Act, rulings are made by the industry minister, a politician, and require only that the proposed transaction show a "net benefit" to Canada, a largely subjective assessment. Second, on 02 Nov 2010, Canadian Government again utilized the Investment Canada Act to block the proposed US$38.6 billion purchase of Potash Corporation, a Saskatchewan fertilizer miner and producer, by BHP Billiton, a large Australian mining company. Most recently, on 20 Mar 2012, Gencore International PLC was required to make several adverse deal structure concessions, such as divesting assets which comprise a majority of the Canadian operations segments to Agrium Inc. and Richardson International Ltd., to ensure regulatory approval for its US$6.1 billion acquisition of Viterra Inc., a global grain and logistics business that was headquartered in Saskatchewan. In addition, Canadian protectionism concerns have been raised in the Nexen and Progress oil/gas transactions as foreign acquirers have pursued companies listed in Canada (never mind the fact that a majority of the respective target companies' assets were outside Canada). Thus, based on these recent poignant examples of Canadian resource nationalism and protectionism being utilized to derail merger agreements with compelling industrial logic, it seems unlikely any rational railroad peer would attempt a take-over or merger run at Canadian Pacific in light of its extremely rich valuation metrics and the adverse geopolitical environment. Pair-Trade Possibility - Short CP/Long CNI Because CP is up a shocking 51% over the last 6-months versus 11% for CNI and 67% versus 24% for the last 12 months, respectively, a pair-trade with a short CP leg and long CNI leg maybe attractive for those with a bullish macro perspective. In addition, because CP currently trades at a significant valuation premium to CNI, it is likely this relative valuation dichotomy will converge over time. Moreover, CNI should benefit from a more robust operating history and key structural advantages of 1) larger network size, 2) higher US exposure, and 3) more efficient track operations.

While a pair-trade introduces some basis and tracking risk to the investment thesis, it seems to be an appropriate macro hedge in light of increased interest in infrastructure investing and potential bulk commodity demand volatility. Conclusion Like our prior report on Mellanox Technologies, Ltd. (NASDAQ:MLNX) in September 2012 when the firm's shares were trading at a shocking $119/share, Canadian Pacific Railway Limited (NYSE/TSX: CP) is an overvalued company with limited potential upside. Below are the top five reasons why long investors should consider selling their position in CP or why aggressive traders should consider entering into a short-sale position:

Disclaimer The author of this report is short CP. ValueWalk Staff Vancouver Island |

Like its peer Canadian National Railway Company (NYSE: CNI)

(TSX: CNR), Canadian Pacific is a Class 1, transcontinental mainline railway. A core tenet of the mainline rail business is funneling as much rail traffic from

feeders and connectors as possible onto a high-density mainline railway network. Thus, the two main divers of railway profitability/cash-flow are carload

volumes and cost controls, both of which are intended to be maximized through the economies of scale in the mainline business model. In addition, the

railroading business in general has high sustaining capital intensity, as both the physical track and the rolling stock (locomotives and rail cars) require

frequent maintenance and replacement to sustain efficient and safe operations.

Like its peer Canadian National Railway Company (NYSE: CNI)

(TSX: CNR), Canadian Pacific is a Class 1, transcontinental mainline railway. A core tenet of the mainline rail business is funneling as much rail traffic from

feeders and connectors as possible onto a high-density mainline railway network. Thus, the two main divers of railway profitability/cash-flow are carload

volumes and cost controls, both of which are intended to be maximized through the economies of scale in the mainline business model. In addition, the

railroading business in general has high sustaining capital intensity, as both the physical track and the rolling stock (locomotives and rail cars) require

frequent maintenance and replacement to sustain efficient and safe operations.

Because of some current pipeline capacity constraints in

moving liquids out of Alberta and North Dakota, the crude oil pricing differential to PADD III (Gulf Coast) has been US$30/barrel, making rail-transport a

price-competitive alternative at this time. However, as the Keystone XL, Northern Gateway, and Trans-Mountain pipeline expansion projects move closer to

fruition, astute investors should remember that, on a mile-for-mile basis, pipeline transport of crude is roughly half the cost of transport via rail and is

significantly safer with lower probability of catastrophic spills or leaks. Moreover, the pricing dislocation between crude and natural gas has significantly

crimped demand for coal, further limiting CP's potential for consolidated volume and revenue growth.

Because of some current pipeline capacity constraints in

moving liquids out of Alberta and North Dakota, the crude oil pricing differential to PADD III (Gulf Coast) has been US$30/barrel, making rail-transport a

price-competitive alternative at this time. However, as the Keystone XL, Northern Gateway, and Trans-Mountain pipeline expansion projects move closer to

fruition, astute investors should remember that, on a mile-for-mile basis, pipeline transport of crude is roughly half the cost of transport via rail and is

significantly safer with lower probability of catastrophic spills or leaks. Moreover, the pricing dislocation between crude and natural gas has significantly

crimped demand for coal, further limiting CP's potential for consolidated volume and revenue growth.