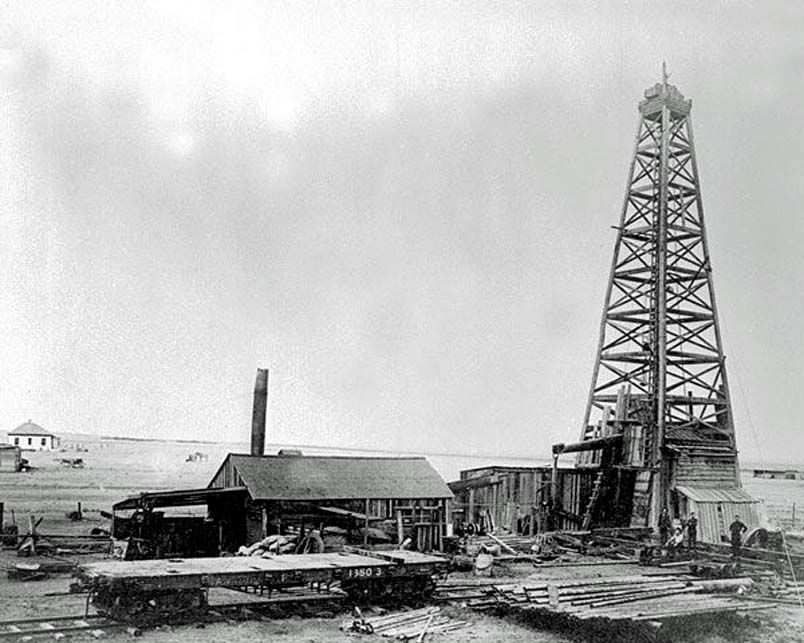

Canada - Encana Corporation can trace its roots back to the 1880s and the building of the Canadian Pacific Railway (CP).

But the birth of the company that now aims to shift its head office out of Canada after calling it home for 135 years, was amid fire and explosion and

"quite by accident," according to the CP website.

The government of Sir John A. Macdonald granted CP drilling rights along the route and it discovered gas in southern Alberta.

"CP was the first company in Canada to discover and develop the use of natural gas as a source for heating fuel. In December 1883, while searching for

water at Langevin, Alberta, 35 miles west of Medicine Hat, CP employees discovered natural gas rushing out of the well tube.

"Unfortunately, two employees were injured in the following explosion and fire," CP said on its website.

"Another well was drilled the following year, and the natural gas from this well was used to heat the station and an adjacent bunkhouse. This was the

first recorded use of natural gas as a heating source in Canada."

Decades later CP formed Canadian Pacific Oil and Gas to manage its properties and mineral rights.

A 1971 merger with Central-Del Rio Oils to improve its natural gas output led to a name change, PanCanadian Petroleum Ltd.

The company was Canada's largest independent oil and gas producer at the time.

Eleven years later it moved its corporate headquarters to Calgary and by the 1990s was producing 260,000 barrels a day.

A slight name change followed in 2001 to PanCanadian Energy Corp. and the exploration expanded abroad with a British discovery.

Output nearly doubled.

Come 2002 and PanCanadian Energy was spun out of CP and merged with Alberta Energy Corp. to form Encana.

The Alberta Energy Co. was formed in 1973 as a 50:50 government and private ownership before the government shares were sold in 1993.

As the decade progressed it expanded with acquisitions taking it to Ecuador and Wyoming.

Encana sold some assets, such as two Alberta pipelines for $1.6 billion, and its interest in Syncrude for more than $1.4 billion, then expanded with new

projects in Alberta, California, Louisiana, and Brazil.

To help streamline operations, in 2009 Encana split into two companies with its oil business forming Cenovus Energy while Encana continued in gas exploration

and production.

Also that year, a pipeline in northeast B.C. exploded releasing tons of poisonous gas that affected local residents.

Authorities later found the pipeline hadn't been cleaned properly before use and that the company hadn't followed its own safety response plan.

Around that time the company's gas pipelines in northern British Columbia were bombed five times, perhaps by an eco-terrorist fearing the potential effects of

poisonous gas on local communities.

Encana's engagement with the Far East's quest for new sources of energy saw deals with Korea Gas Corp. for developing northeast British Columbia, and Toyota

Tsuho Corp.

In 2012 it sold a 40 percent interest in the Cutbank Ridge Partnership, about 400,000 acres of natural gas prospects in northeast British Columbia, to Japan's

Mitusbishi Group.

Later that year it inked a US$2.1 billion joint venture with PetroChina, giving the Chinese government company 49.9 percent of Encana's stake in the Duvernay

formation in Alberta.

In 2013 Encana was accused, along with Chesapeake Energy, of alleged bid rigging in land leases to divide up Michigan counties for shale drilling in

2010.

Authorities from the U.S. Justice Department, the Internal Revenue Service, and the Securities and Exchange Commission investigated.

Encana paid US$5 million to settle the case in 2014.

The commodity price rout that followed the financial crisis forced Encana to lay off 20 percent of its circa 4,200 workforce in late 2013 and focus on five

oil-related projects in North America, down from about 30.

The next year Encana sold its Bighorn assets in Alberta to Jupiter Resources for US$1.8 billion and expanded its presence in Texas shale exploration by

spending $3.1 billion for assets from Freeport-McMoRan.

Then in November Encana paid $7.1 billion to buy Athlon Energy.

As low commodity prices continued to bite into project financing, Encana sold interests in the Haynesville Shale area in Arkansas and Louisiana for $850

million in 2015, then slashed its dividend and capital spending budget.

Revenue for 2015 plummeted 45 percent and the company posted a staggering US$5.17 billion loss.

More divestment followed with the sale of Colorado assets in the Denver Basin for $900 million in 2016 and the Piceance Basin for $735 million a year

later.

Encana has swung into profitability in recent years, finishing 2018 with net earnings of US$1.07 billion and production of 361,200 barrels of oil equivalent a

day.

Colin McClelland.

provisions in Section 29 of the Canadian

Copyright Modernization Act.