Calgary Alberta - Today, Canadian Pacific Railway Limited (CP) announced that it recently sent a letter to the President and Chief

Executive Officer of Kansas City Southern (KCS) regarding the anti-competitive impacts of the proposed Canadian National (CN) transaction with KCS.

The full text of the 23 Apr 2021 letter is below:

Pat Ottensmeyer

President and CEO

Kansas City Southern

427 West 12th Street

Kansas City, Missouri 64105

Dear Pat:

I am writing to address some of the statements CN has publicized over the past 24 hours concerning an issue that I expect will weigh heavily as your Board

gives due consideration to CN's proposal.

The misrepresentations made by CN's CEO have led us to, once again, respond with the undeniable facts.

Either Mr. Ruest does not fully understand his proposed transaction or he doesn't want to reveal what he knows.

Either way, the bond and trust CP has built with you, KCS as a whole, and the communities we collectively serve, is too important to ignore.

In its letter this morning to the STB in our CP/KCS docket, CN has now discussed in more detail its view of the competitive impacts of a hypothetical CN/KCS

transaction and how CN plans to remedy those impacts.

I am confident that you and your Board have a thorough understanding of all of the dimensions of competition between KCS and CN, but I thought it would be

useful to place some of those issues in the context of how we strongly believe the STB will evaluate the public interest consequences were a CN proposal ever

to proceed through the regulatory process.

The Breadth of Horizontal Competitive Overlaps Between KCS and CN

I am sure I do not need to belabor the extent of the competitive overlaps between KCS and CN.

As you know, the competition between KCS and CN is not limited to a "handful" of shippers as CN suggests.

KCS and CN serve the same shippers, the same cities, the same corridors, and the same regions across much of KCS's U.S. network.

Your counsel will be able to confirm that analysis of available data shows that combining KCS with CN will reduce shippers' competitive options across an

extensive number of origin-destination pairs.

That is not just because KCS and CN serve shippers in common, but because your networks connect the South Central States with the U.S. Midwest, Canada, and

other regions, providing competitive routing options that will be extinguished by the CN/KCS proposal.

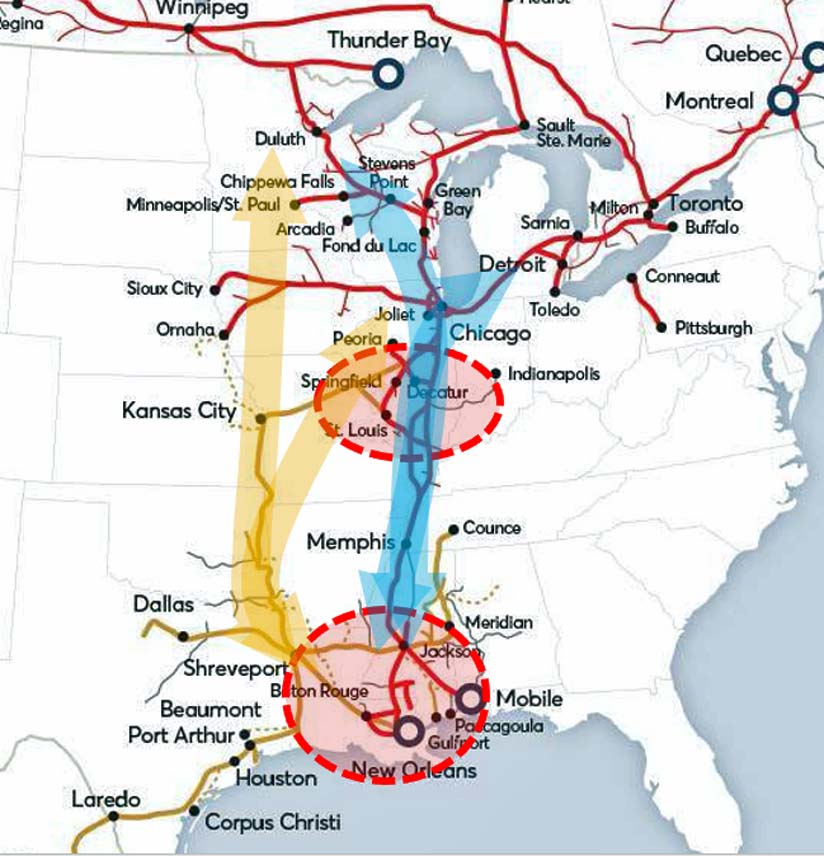

The map below illustrates just some of the obvious routing overlaps, examples like New Orleans-Chicago/Detroit/Twin Cities, Jackson-Chicago/Detroit/Twin

Cities, Baton Rouge-Chicago/Detroit/Twin Cities, St Louis-Baton Rouge/New Orleans, Alberta-Baton Rouge, Detroit-Dallas/Jackson, and countless others

(Figure 1).

These reductions in competing routes are not solely the product of individual shippers that are dual served, contrary to CN's suggestion.

They flow from the broadly parallel route structure of CN and KCS between Springfield, Illinois, and New Orleans.

The loss of horizontal competition from a CN/KCS transaction goes farther than this, to include lost options for shippers on connecting shortlines, lost

geographic competition, and lost build-in/build-out opportunities.

For example, CN and KCS account for more than half of all rail freight revenue for traffic to/from Mississippi.

Even where there is no direct shipper overlap, the two railroads move the same commodities (like forest products and grain) to/from alternative origins or

destinations in Mississippi and throughout KCS's South Central United States service territory.

The close proximity of KCS and CN's lines between Baton Rouge and New Orleans not only mean numerous shippers will lose one of their current rail options, but

also extinguishes the opportunity to discipline post-merger CN by building in or out to another railroad (as has occurred in the past).

None of this has escaped the attention of the shipper community, Cowen released a survey today of over 100 shippers and reports that 45 percent had a negative

view of the CN merger (vs 18 percent of ours in Cowen's previous survey), and that 20 percent said that CN/KCS would "cause them to lose a rail shipping

option."

CN appears to believe that the only transportation competition that matters in North America is competition from trucks and the existence of at least two

railroads serving individual shippers.

As I am confident your counsel will confirm, this is not how the STB will view railroad competition under the 2001 merger rules.

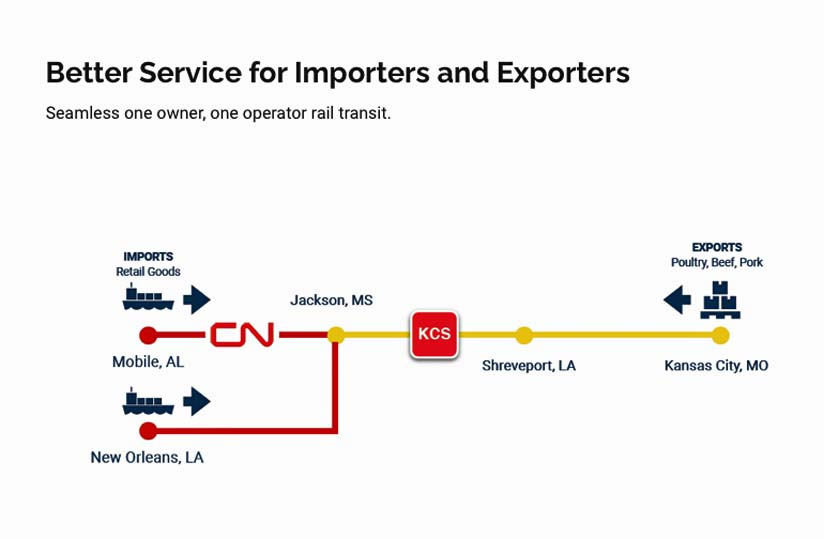

One illustration of CN's overly narrow perspective is the diagram on its own "Connected Continent" website showing supposedly new "single-line

service" between Kansas City and the ports of New Orleans and Mobile, Alabama.

CN's diagram is reproduced below (Figure 2):

This diagram is stunningly ignorant of the basic competitive landscape.

It simply ignores that KCS already connects Kansas City with both Mobile and New Orleans via single-line service.

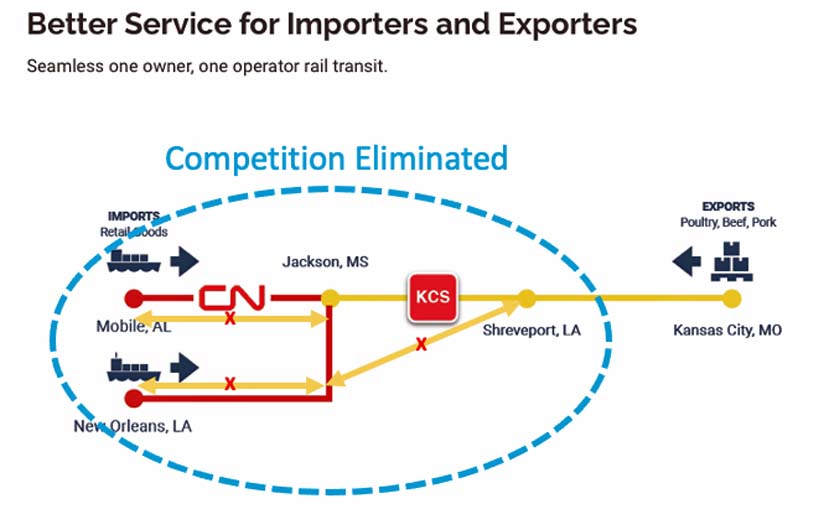

Once that fact is understood, it is also obvious that the CN/KCS transaction would directly reduce rail competition at both of these ports, as the corrected

diagram makes clear (Figure 3):

CN's 23 Apr 2021 letter to the STB suggests that this loss of competition to the Port of Mobile is meaningless, because "the Port is served by

multiple other railroads, including Class Is."

CN 23 Apr 2021 Letter at 3.

I doubt shippers and the STB will see it that way.

Another reflection of CN's misguided view of competition is its effort to wave away competitive issues by saying that CN will work with "dual-served"

customers to "ensure they would not become sole-served as a result of a CN-KCS transaction."

CN 23 Apr 2021 Letter at 3, see also id.

("If KCS chooses to partner with CN, CN will propose effective solutions, working closely with these customers to ensure that no customer will become sole

served.").

With respect, this approach ignores the approach to competition that the STB spelled out when it adopted its 2001 merger rules.

For example, as the 2001 rules explain, "the Board believes additional consolidation in the industry is also likely to result in a number of

anti-competitive effects, such as loss of geographic competition, that are increasingly difficult to remedy directly or proportionately."

49 C.F.R. § 0.1(c).

CN may think it can persuade the STB to allow the CN transaction to eliminate KCS as an independent competitor in North South (and East-West) routes, and

across the broadly overlapping South Central region, based on discrete remedies for a handful of "2-to-1" shippers.

But we think that assessment is extraordinarily out of touch with the Board's 2001 rules and today's regulatory landscape.

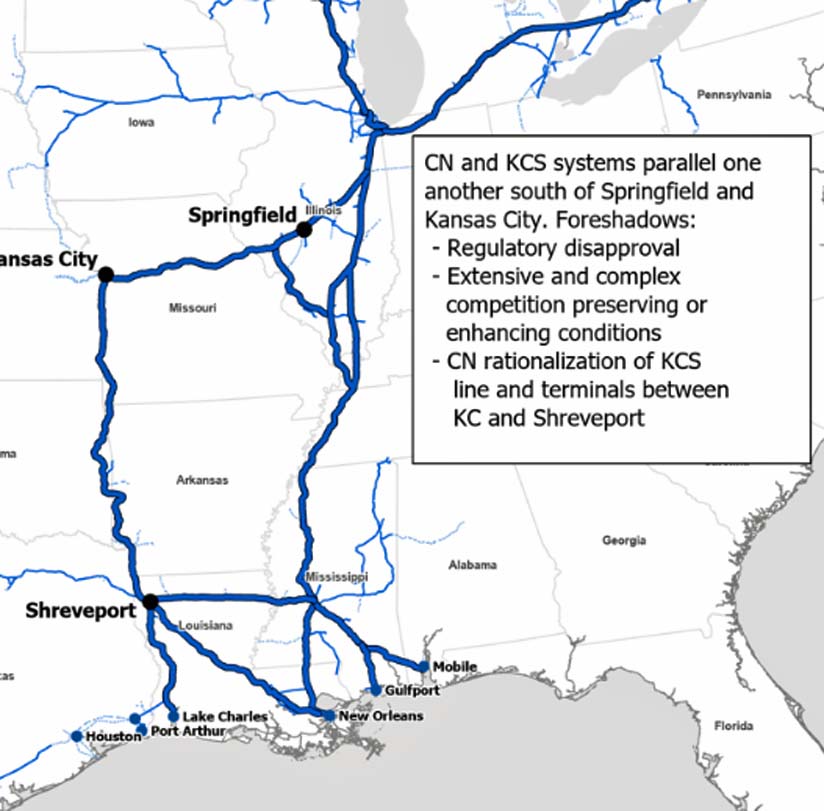

The fact that the CN and KCS systems parallel one another south of Springfield and Kansas City (as shown in more focus in the map below) foreshadows regulatory

disapproval, extensive and complex competition-enhancing conditions, or the dismemberment of KCS as CN ultimately rationalizes these parallel lines and

terminals (Figure 4).

Impact of Competitive Overlap on STB's Voting Trust Analysis

As you and your Board evaluates CN's proposal, we understand that a likely gating question is whether CN would be allowed to close into trust.

CN has made clear that it will proceed under the 2001 merger rules and will soon be filing a motion seeking "public interest" review of its proposed

use of a voting trust.

On this issue too, CN's analysis of the issues is out of touch with reality.

CN suggests that the only issues the STB will view as relevant are (a) whether the trust agreement itself insulates KCS from control by CN and (b) whether KCS

can be sold if the merger is disapproved.

CN Notice of Intent at 7-8.

CN suggests that on these issues there is no difference between its proposal and the voting trust proposal we have agreed upon.

With respect, CN is missing two big parts of the regulatory picture.

First, any public interest review will certainly consider the likelihood that, at the end of the regulatory review process, KCS would become part of the

acquirer's system as planned.

For all of the reasons covered above, along with many others (perhaps most importantly the destabilizing effect of CN's transaction on industry structure and

the potential for downstream consolidation) the back-end regulatory risks associated with CN's proposal will cause the STB to be reluctant to allow KCS to go

into trust at the front end.

Second, the head-to-head competition that even CN acknowledges must be remedied makes the use of a voting trust uniquely inappropriate in a CN/KCS

transaction.

DOJ's comments on the CP/KCS voting trust proposal emphasized a specific source of harm to competition from the use of voting trusts that applies uniquely to

CN's proposal (and not to CP's), namely that the incentives of the railroads to compete will be dampened while one (KCS) is already in trust, and the other

(CN) already receives the benefit of that ownership through its ownership of shares.

DOJ Comment at 3-4.

In light of the extensive competition between KCS and CN, which you are more keenly aware of than I, DOJ and the STB will see this as a serious

concern.

And none of the competitive remedies that CN might ultimately devise can possibly eliminate this harm, because, as CN acknowledges, they would come at the end

of the regulatory process, not when KCS is acquired and its shares go into trust.

CN Analyst Call Tr. 15 (Mr. Finn) ("we can address them as they arise, and the decision by the STB ultimately will impose those conditions, if

required").

Pat, I understand that you and your Board must give the CN proposal all of the consideration that it deserves.

But I submit that when you consider the regulatory issues CN's proposal raises, and our agreement does not, you will see that CN's proposal is an illusory one

that should not distract KCS from the once-in-a lifetime partnership that our mutually agreed transaction represents.

These two companies have long, proud, histories and an even brighter future, together.

Respectfully,

Keith Creel - CP President and CEO

On 23 Apr 2021, the Surface Transportation Board confirmed that the waiver it granted to KCS in 2001 is applicable to the proposed combination of CP/KCS

because it would still result in the smallest Class 1 railroad, with the fewest overlapping routes, and be end-to-end in nature.

Author unknown.

(because there was no image with original article)

(usually because it's been seen before)

provisions in Section 29 of the Canadian

Copyright Modernization Act.