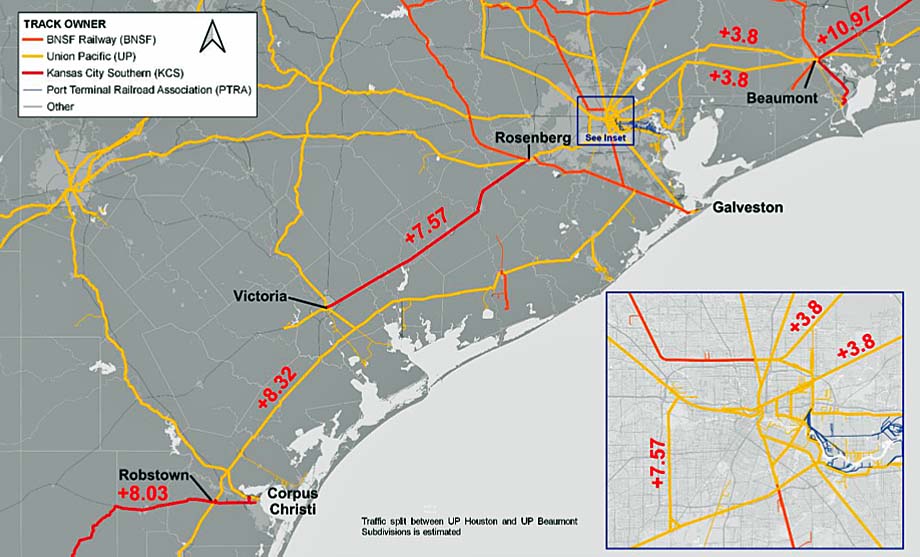

Washington District of Columbia USA - Projected traffic increases from the CPKC merger will put the

critical Houston terminal into gridlock, BNSF Railway has warned federal regulators this week, citing a new

analysis.

CP and KCS expect to run eight additional trains per day through Houston, thanks to new single-line service they'll

offer if their merger is approved.

But the railroads have not proposed capacity expansion projects on KCS trackage-rights routes across South Texas, which

are part of its international corridor between Beaumont and the Mexican border at Laredo.

"The CPKC operating plan, train volumes, train lengths, and available siding lengths, are incompatible. Without

any additional infrastructure, the train sizes stated by CPKC would result in gridlock," wrote Mark Dingler of

HNTB Corp., who conducted a Rail Traffic Controller study for BNSF.

BNSF's comments were among those filed on 12 Jul 2022, the deadline for interested parties to chime in on so-called

responsive applications and other requests that ask regulators to impose various conditions on the proposed CPKC

merger.

"Given the history of merger-caused traffic disruptions in the Houston area in past mergers, and the sharp

increases in traffic projected to move through Houston by Applicants, it is astonishing and very troubling, that

Applicants have identified no capacity additions in the Texas Gulf region that will be needed to handle the new merger

traffic," BNSF told the board.

"Indeed, Applicants have not even formally studied the issue."

Houston was ground zero for Union Pacific's 1997-1998 meltdown following its acquisition of Southern

Pacific.

BNSF repeated its call for the STB to prohibit CPKC from running more traffic through Houston until it funds and

installs necessary capacity in Houston, and elsewhere in Texas, on trackage-rights routes, including the Neches River

Bridge in Beaumont.

CP says concerns about Houston capacity have no merit.

"Even though CPKC will have no interest in overburdening this infrastructure, and thereby interfering with its own

efforts to attract traffic moving via other rail routes today, UP and BNSF theorize that additional CPKC trains will be

the straws that break the camel's back," CP wrote in its filing to the board.

"This is nonsense. The Houston Terminal has extensive available capacity, provided it is managed efficiently, and

extensive additional capacity is in the pipeline as a result of projects UP has underway today."

CP says that capacity projects in Houston since the UP-SP merger have improved the terminal.

"Unlike many rail terminals, Houston is blessed with multiple alternative through routes, all with multiple

(double or triple) tracks," CP wrote.

CP also noted that even with traffic increases it will remain a minority user of the Houston terminal, which is

dominated by UP and BNSF.

Their trains enter and exit yards, KCS trains pass through the terminal without switching.

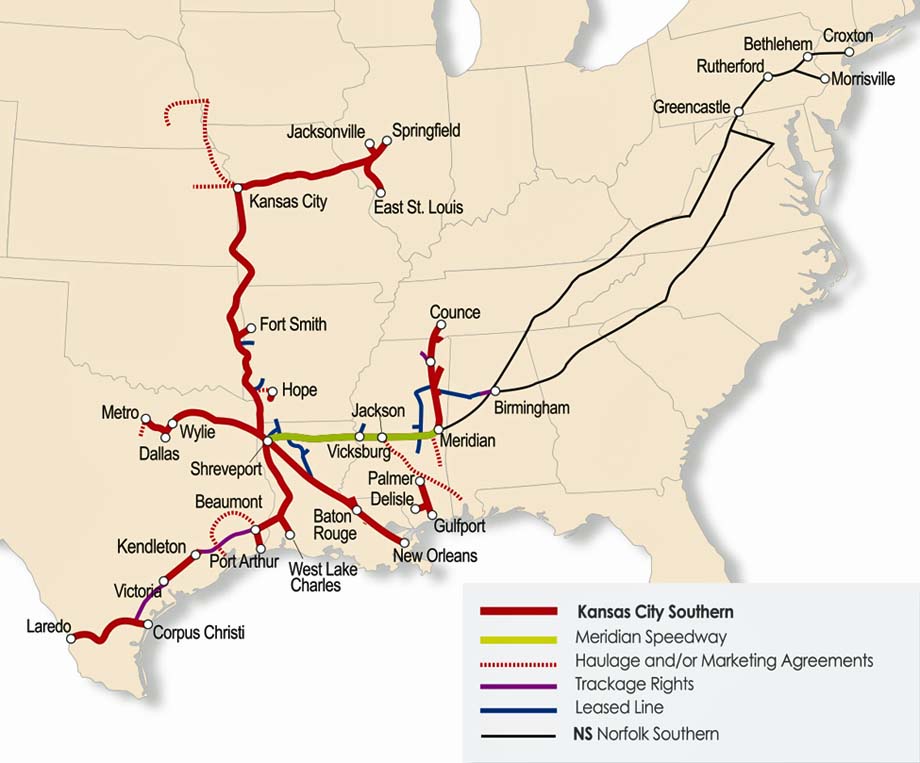

J.B. Hunt Seeks Protections to Reach Mexico

Among the other filings to the STB were the first comments from intermodal shipper J.B. Hunt, which echoed concerns

raised by Class I railroads regarding the Laredo gateway, the busiest rail border crossing in North

America.

J.B. Hunt, like the railroads, urged the STB to impose protections on the Laredo gateway as part of any approval of the

CPKC merger.

J.B. Hunt's traffic to and from Mexico moves via BNSF Railway, KCS, and KCS de Mexico under an interline service

agreement that dates to 2016.

About 85 percent of Hunt's cross-border traffic originates in Mexico, with Chicago being the largest single

destination.

KCS and KCSM have had an incentive to cooperate with BNSF and J.B. Hunt because they can't reach Chicago without

interchange.

But J.B. Hunt fears that cooperation will vanish under a CPKC merger, because the combined railroads will aim to divert

intermodal shipments to their new single-line service between Mexico and Chicago.

BNSF has talked with KCS about extending the interline service agreement so that J.B. Hunt can continue to compete

effectively for cross-border traffic after the merger.

No deal has been reached, Hunt says, aside from a short-term extension of the interline service agreement.

Separately, Hunt also was unable to reach an agreement with CP and KCS about maintaining the viability of its service

to Mexico via BNSF.

CP and KCS have promised to keep all gateways open, both physically and commercially.

But J.B. Hunt has asked the STB to condition its approval of the merger on protecting the Laredo gateway.

"In order to effectively preserve existing rail-to-rail competition for cross-border Mexican traffic through the

Laredo Gateway there must be an enforceable mechanism for establishing an actual, competitive, proportional, rate for

the movements by the merged CPKC in Mexico, and to and from Robstown that would be part of through rates offered by

other Class I rail carriers," J.B. Hunt told the board.

The issue could be resolved, Hunt says, if CPKC would agree to a long-term extension of the existing BNSF-KCS interline

service agreement and making it a condition of the merger.

Port of New Orleans

The New Orleans Public Belt Railroad Commission and the Port of New Orleans oppose Norfolk Southern's request for

conditional trackage rights over KCS's line between Shreveport, Louisiana, and Wylie, Texas, outside

Dallas.

NS is seeking the trackage rights to protect its interline intermodal service with KCS that links Dallas and the

Southeast via their Meridian Speedway joint venture.

The trains currently use haulage rights west of Shreveport.

The trackage rights NS seeks would become active only if CPKC suffered service failures and NS exercised its option to

purchase the Wylie Terminal.

NS contends that a combination of traffic increases and operational changes are likely to impair intermodal

service.

The port and railroad told the STB that giving NS trackage rights would not solve congestion issues.

"In fact, adding more trains run by a second carrier over the segment would likely exacerbate the problem,"

they told the STB.

KCS currently handles intermodal traffic between the port and Dallas, and port officials fear that any congestion would

harm the port's customers.

CP says NS misread the operating plan, and that traffic would be reduced on the Meridian Speedway, due to consolidation

of trains.

Increases on KCS between Shreveport and Wylie would be small, CP says.

Meridian Speedway Dispute

Norfolk Southern, meanwhile, says regulators should reject CSX Transportation's attempts to blow up its exclusive right

to move intermodal traffic over the Meridian Speedway.

CSX argues that the Meridian Speedway agreements NS and KCS negotiated in 2006 are unlawful, limit competition, and

should face STB review as part of the CPKC merger.

But NS says CSX's claims are baseless, particularly since the railroad raised no concerns when the joint venture was

formed 16 years ago.

In response to the NS-KCS interline service, CSX and BNSF reached a deal that gave BNSF intermodal access to Atlanta,

NS notes.

Bill Stephens.

(likely no image with original article)

(usually because it's been seen before)

provisions in Section 29 of the Canadian

Copyright Modernization Act.