Canada - I was listening to some podcasts recently regarding the potential rail strike in the

United States, and one of the things a guest said was that rail companies down there were making record profits while

employing fewer workers and hauling more freight.

So, I was curious if the rail industry in Canada was experiencing something similar.

I combed through the annual reports for both CP and CN, the two largest rail companies in Canada, going back to 2006

and 2009, respectively.

Then I specifically compiled the net income (profit), workforce size, and gross ton miles reported by

each.

For the workforce, I included all paid workers, including contract workers.

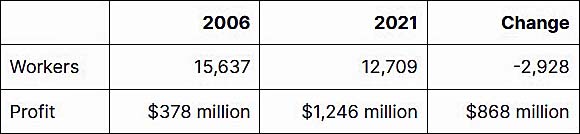

First, let's take a look at CP.

What we see here is that CP has seen profits rise by nearly $900 million over the last 15 years.

Yet, the number of workers whose labour generates the revenue where that increase in profit comes from has dropped by

just under 3,000.

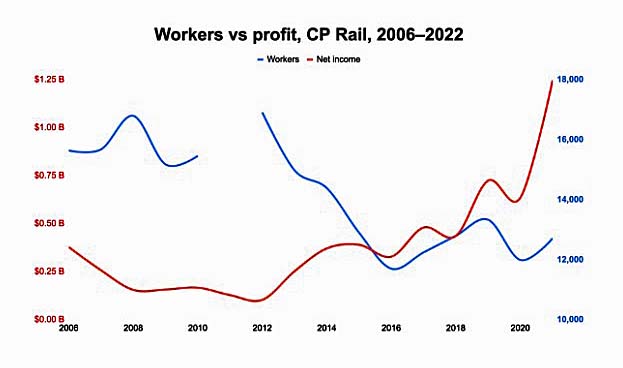

And while this may seem remarkable, check out a graph showing the numbers year-over year.

Unfortunately, I couldn't find worker data for 2011.

However, what becomes apparent in this view is that not only have profits risen and workers dropped over the last

decade in a half, but there seems to be a strong correlation between the two, as if having fewer workers hauling the

same amount of freight leads to more profit for those at the top.

According to the company's annual reports, their trains saw 272,360 million gross ton miles in 2020.

In 2007, their GTMs were only 246,322.

That's an increase of 26,038.

As a result of more freight and few workers, the average worker went from hauling 15.71 gross ton per mile in 2007 to

21.43 per mile in 2020.

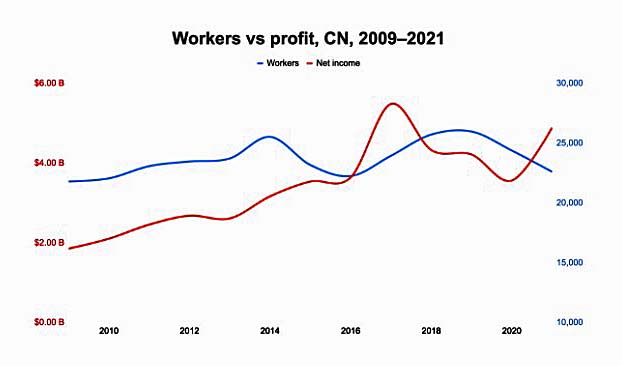

Now, let's check out CN.

Here we see that CN also saw an increase in profits, but their workforce also increased by over

800.

Now, take a look at their graph.

In contrast with CP's graph, this one shows mild profit growth, while the workforce has been relatively

stable.

Which goes to show that laying off workers isn't a requirement for increased prices.

GTMs for CN were 458,401 in 2021, which is up by 153,711 from the 304,690 the company saw in 2009.

And even though CN has increased their workforce, unlike CP, they're still expecting the workers they do have to work

harder.

In 2009, the average CN worker hauled 13.98 gross tons per mile.

Yet last year, the average worker hauled 21.03 per mile.

Either way, both companies appear to be exploiting their workers for their gain.

And that's not even looking at wages.

Kim Siever.

I'm not sure I buy this guy's theory. Train lengths have

increased over the years. If anything it shows poor performance by CN. Could the loss of KCS and the subsequent new CN

CEO shakeup have anything to do with this?

I'm not sure I buy this guy's theory. Train lengths have

increased over the years. If anything it shows poor performance by CN. Could the loss of KCS and the subsequent new CN

CEO shakeup have anything to do with this?

(likely no image with original article)

(usually because it's been seen before)

provisions in Section 29 of the

Canadian Copyright Modernization Act.